Table of Contents

Meaning of Inflation

Inflation is a sustained increase in the overall level of prices and the continuous decrease in the purchasing power of money. This means that there is a persistent rise in the general prices of goods and services. For an economy to have inflation, then the prices of all the goods and services should be increasing the prices must not all increase at the same rate but there must be increment. Another thing to note about inflation is that the prices do not just increase but the increment must be persistent; therefore a persistent increase in the level of prices of the goods and services generally is what can be described as Inflation. The sustained rise in the general prices of goods and services is what differentiates inflation from other price fluctuations.

Differentiating Inflation and other Changes in Prices of goods and services

- Relative Price increase: When there is a relative increase in price, that cannot be termed as inflation; take for example, when the price of buying cars increase but the price of fuel or laptops or tuition fee are still same this is a relative price increase and not inflation.

- Price Instability: this is a periodic rise and fall of general prices of goods and services that are not persistent. In price instability, the rise is associated with a fall and the rise in prices is not persistent.

- Re-inflation: this is a deliberate rise in prices of goods and services that is usually caused by the government.

The criteria and definition of inflation may seem like something that is difficult to occur but it is the easiest occurrence an economy may have if not controlled properly.

Two Major Types of Inflation

There are two major types of inflation in terms of the rate at which the rise in prices of goods and services occurs.

- Creeping Inflation ( Chronic or Persistent Inflation): this occurs when the rise in the general price level is slow but steady.

- Galloping Inflation or Hyper-inflation: this refers to a rapid rise in the general price level. At some point in Germany in 1923, the annual inflation rate was 6,829 percent such that ordering two cups of coffee 30 minutes apart could make you pay 25% more on the second cup of coffee because the price has increased over the 30-minute interval.

Other Types of Inflation

- Demand-pull inflation: this type of inflation occurs as a result of excess demand over Supply. It is pulled into occurrence as a result of high demand with no associated supply of goods or services. This type of inflation occurs especially when there is an increase in income of people without a corresponding increase in production to match their demand. When

- Cost-push inflation: this type of inflation results from a persistent increase in the cost of acquiring the factors of production thereby making the producers push part of the cost on the consumers in order to maintain their profit margins. Assuming the cost of acquiring labor increases or the cost of acquiring land for production increases in order for the producers to make a profit, they will push part of the cost of the factors of production on the consumers by increasing the price of their goods or services.

- Open inflation: this type of inflation occurs as a result of persistent excess supply of money with no corresponding increase in the volume of goods and services leading to excess money trying to buy fewer commodities which then causes a rise in the general price level. This is usually caused by excessive lending by commercial banks or over-expansion of currency by the central bank.

Causes of Inflation

- The rapid increase of government expenditures

- Excessive bank lending

- Increment of wages and salaries

- Low domestic productivity

- Poor storage facilities

- Increase in population

- Shortage of essential commodities due to poor system of distribution

- War and civil strife

- Imported inflation

- Higher costs of production

- Reduction of imports

The rapid increase of government expenditure

An increase in government expenditure can cause inflation. This occurs when the government spends more money than it has. The government gets money through taxes and selling of natural resources or other means of transactions; when the government starts to spend more money than what it is getting either by borrowing or by asking the central bank to print more money (this act of borrowing more money or printing more money in excess of what the government really has is called deficit-financing), there will be an excess supply of money and if this is not matched by an increase in goods and services, then open inflation will occur.

Excessive bank lending

Just as deficit financing by the government leads to an increase in money supply, excessive bank lending also leads to more money in supply and when there is no corresponding increase in goods and services, then open inflation will occur.

Increment of wages and salaries

An increase in wages or salaries leads to an increase in purchasing power and a subsequent increase in demand for goods and services. When there is no corresponding increase in productivity, then demand-pull inflation occurs. Sometimes, when traders know of an increase in salaries and wages, they intentionally push the prices of commodities upwards and this leads to inflation.

Low domestic productivity

When the production of goods and services is hampered by lack of capital, poor infrastructure such as power supply, water, good access roads, and also lack of manpower, then there will be excess Demand over Supply and therefore the few goods produced will be high because of the difficulty in production.

Poor storage facilities

Poor storage facilities make it difficult especially for agricultural goods to be stored, perishable goods such as tomatoes, fruits, yams, etc and this causes the proto waste away and when their seasons are gone, they become scarce and therefore prices are increased.

Increase in population

When there is population growth, there will be excess demand over Supply and this leads to inflation as more people are demanding fewer goods and services, there will be competition by consumers and prices would go up. Countries such as India, Nigeria, the USA, and China may experience this type of inflation due to population growth except there is a corresponding increase in production.

Shortage of essential commodities due to poor system of distribution

Poor distribution of essential commodities mostly caused by poor road networks, too many middlemen in the process of distribution, and congestions of ports. Poor road networks make it difficult to transport goods and in turn leads to a shortage of goods; the same shortage can be caused by port congestions especially to imported goods and the presence of too many middlemen leads to hoarding and raising of prices of goods before getting to the consumers.

War and civil strife

The presence of war or crisis hampers the productivity of goods and services thereby increasing scarcity and leading to an increase in prices.

Imported inflation

Reliance on imported goods could lead to inflation when those goods are imported from countries with existing inflation this causes the price of the imported goods to be sold at higher prices to the importers who in turn sell at higher prices to the consumers in order to make a profit.

Higher costs of production

Whenever the cost of production of goods in a country becomes high due to whatever cause, it leads to prices of goods being increased because the producers will have no choice but to increase the prices in order to make gains.

Sudden harsh policies on imports

When the government makes sudden policies on goods that are imported such as a ban on some products without actually waiting for the locally produced goods to be enough for the population, then there will be a scarcity of the goods and a corresponding increase in their prices.

Effects of Inflation

The effects of inflation could be beneficial as well as adverse. The disadvantages and advantages of inflation would be discussed below.

Advantages and Disadvantages of Inflation

- Increased employment

- Transfer of real earnings

- Adverse balance of payments

- Discourages savings

- Increased earnings and higher profits

- Increased investment

- Redistribution of income

- Reduction in the burden of the national debt

- Loss of confidence in the currency

Increased employment

Because of the increased prices, the businessmen would want to capitalize on it in order to gain more profits, this makes them increase production which requires more business expansion and subsequently more labor. This increases employment.

Transfer of real earnings creditors will lose and debtors will gain

The fall in the real value of money caused by inflation will cause the amount of money borrowed by debtors to be less valuable and this makes it easier for the debtors to pay back but makes the creditors lose because the value before they gave the money was higher and after giving the money the value had fallen making them lose.

Adverse balance of payments

Inflation affects the prices of exports because the increase in prices makes other countries import less from the affected country; the imports of the country with the inflation become increased because the prices become relatively cheaper this creates more spending on imports than exports and the balance of payments becomes worsened.

Discourages savings

Inflation discourages savings because people spend more on buying goods and services and would have less to save. Again, the fall in the value of money discourages people from using money as a store of value because saving 10,000 during inflation which was able to buy a Television may not be able to buy the same TV after few months this discourages people from savings.

Increased earnings and higher profits

At the initial stages of inflation, traders usually earn higher profits due to an increase in prices of their goods and services especially when wages and other costs are still lagging behind output prices.

Increased investment

The possibility of higher profits at the initial stage of inflation attracts business investments because investors would want to capitalize on the price increase and produce more goods in order to make more gains. It can therefore boost production.

Redistribution of income

There is a redistribution of income from fixed salaried earners to those whose income is not fixed such as entrepreneurs and businessmen. This is because, during inflation, there is a reduction in the purchasing power of the fixed salaries of workers and their salaries can now buy fewer goods and services; this means their real income is reduced. On the other side, entrepreneurs and businessmen gain more and there is an increase in their income because their goods become more costly which means more money for them.

Reduction in the burden of the national debt

When there is inflation, the real value of money borrowed by the government because reduced; if the government had borrowed 10,000, the value of that 10,000 becomes reduced, and can buy fewer goods this, therefore, reduces the burden of the national debt.

Loss of confidence in the currency

When inflation becomes very high and rapid, the people will lose confidence in the currency because the currency becomes worthless as you cannot even use it to buy anything. This occurred in Germany in 1923 when the people were using the currency for decoration of homes instead of buying and selling they started using something more scarce than their currency such as cigarettes until a new currency was created.

How to Control Inflation

The control of inflation can be achieved by controlling the problems associated with both demand and supply. Finding solutions for the demand problems in inflation as well as for supply problems will control inflation.

A. Control of Inflation associated with problems of demand

- Use of fiscal policy

- Use of monetary policy

- Use of physical controls

Use of fiscal policy in controlling inflation

Fiscal policy refers to the regulation of the economy by the government by use of their incomes and expenditures. The government can control inflation by using the following:

- Taxation policy: the government regulates inflation by increasing taxation on income thereby reducing the purchasing power of the people because their disposable income is reduced and therefore the demand for goods and services would be reduced too this then causes a fall in prices, assuming the supply does not fall.

- Issuing of bonds, treasury bills, and stocks: the government can mob the excess supply of money in circulation by borrowing from the public by issuing bonds, treasury bills, and stocks. In the process of buying these offers from the government, the people pay money to the government, and therefore the amount of money in circulation is reduced.

- Reduction in government expenditure: when the government starts to spend less of what it receives, there will be less money in circulation especially when it reduces expenditure on non-productive projects. This then curbs inflation.

Use of monetary policy in controlling inflation

The monetary policy controls the use and availability of credit by the central bank this is intended to reduce the supply of money in circulation. The central bank increases the bank rates, increases cash deposit ratio, use of open market operations, use of directives, moral suasion, and use of special deposits. In controlling inflation, the central bank uses the restrictive monetary policy.

Physical control of inflation

The physical control of inflation can be achieved by the use of price control and a wage freeze.

- Price control: this involves the fixing of prices of goods and services on finished goods as well as on raw materials by a price control board.

- Wage freeze: this is a policy whereby the government resists the calls for salaries and wages increase and also ban strikes and no further review of salaries or wages. This is an effort to reduce the increase in demand associated with an increase in income.

Problems associated with Price control of Inflation

The use of price control as a form of physical control in curbing inflation has problems associated with it; these problems include:

- Disruption of the forces of demand and supply as there will be excess of demand over supply whenever the control price is lower the equilibrium price. On the other hand, when the control price is higher than the equilibrium price, there will be excess of supply over demand.

- Hoarding of commodities in order to create artificial scarcity by the producers and sellers

- Bribery and corruption because officials will be offered bribes in order to allow producers and sellers to sell at higher prices or to avoid prosecution.

- Smuggling of goods in order to sell at higher prices in other countries because the controlled price is low.

- Development of black markets as a result of the control price being lower than the equilibrium price. This forces the sellers and producers to sell behind closed doors only to consumers who are willing to buy at higher prices.

B. Control of Inflation associated with problems of supply

- Increasing the productivity of the industrial and agricultural sector which in turn increases the availability of goods and services. Productivity in these sectors can be achieved when the government provides subsidies for fertilizers and provide improved seeds to farmers. Also, the commercial banks could make it easier in providing loans to farmers.

- Improvement in the distributive system such as good road networks and reduction in the number of middlemen involved in the distribution of goods.

- Making adequate storage facilities that will reduce the spoilage or wastage of goods and also reduce the scarcity of goods.

How is inflation measured?

The Bureau of Labor Statistics (BLS) is responsible for the development of indexes for measuring inflation. These indexes are developed according to the need to calculate inflation in a given group of people. Some experimental price indices were created for the elderly or the poor, some for different geographic areas, and some for certain broad categories of goods like food or housing. The best measure of inflation, therefore, depends on the given application and the intended use of the data;

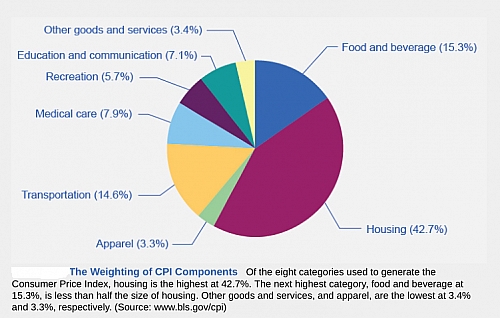

- Consumer Price Index (CPI): CPI measures prices as they affect everyday household spending. In calculating the Consumer Price Index, the first task is to decide on goods that are representative of the purchases of the average household. The most commonly cited measure of inflation in the United States f America is the Consumer Price Index (CPI)

- Core inflation index: this is used by economists by taking the CPI and excluding volatile economic variables. In this way, economists have a better sense of the underlying trends in prices that affect the cost of living.

- The International Price Index: this is based on the prices of merchandise that is exported or imported

- The Producer Price Index (PPI): this is based on prices paid for supplies and inputs by producers of goods and services. It can further be broken into price indices for different industries, commodities, and stages of processing (like finished goods, intermediate goods, or crude materials for further processing).

- An Employment Cost Index: this measures wage inflation in the labor market.

- The GDP deflator: the Bureau of Economic Analysis uses the GDP deflator which is a price index that includes all the GDP components (consumption + investment + government + exports – imports). Unlike the CPI, the GDP deflator re-calculates what the current year’s GDP would have been worth using the base-years prices.

If you are concerned with the most accurate measure of inflation, then the use of the GDP deflator picks up the prices of goods and services produced. However, it is not a good measure of the cost of living as it includes prices of many products not purchased by households (for example, aircraft, fire engines, factory buildings, office complexes, and bulldozers). If one wants the most accurate measure of inflation as it impacts households, one should use the CPI, as it only picks up prices of products purchased by households. That is why economists sometimes refer to the CPI as the cost-of-living index.

What is the Inflation Rate?

The inflation rate is defined as the growth rate of the general price level. In turn, the general price level in the economy is based on the prices of all the goods and services in an economy. From one month to the next, some prices increase, others decrease, and still, others stay the same. The overall inflation rate depends on what is happening to prices on average. If most prices are increasing and few are decreasing, then we expect to see inflation.

Inflation rate = autonomous inflation sensitivity output gap.

Or

Annual Inflation rate = [ (Price Level in current year Price Level in the previous year) / Price Level in previous year] x 100